Did you ever notice that when you put the words “The” and “IRS” together, it spells “THEIRS?”

It is common for all IFTA Licensees to submit fuel tax reports every quarter of the year. The third reporting quarter for IFTA returns (July to September) is due on October 31st 2018, if you prepare and get it post marked before the End of the Month then your return will be considered “Filed on time”.

Information required for preparing an IFTA return:

- The miles you traveled in each jurisdiction

- Total miles you have traveled for the reporting period.

- Gallons of fuel purchased in each jurisdiction

- Very importantly your IFTA License Number

IFTA report must be submitted even if:

- No taxable miles were traveled during the reporting quarter.

- All those miles you have traveled were within your base jurisdiction.

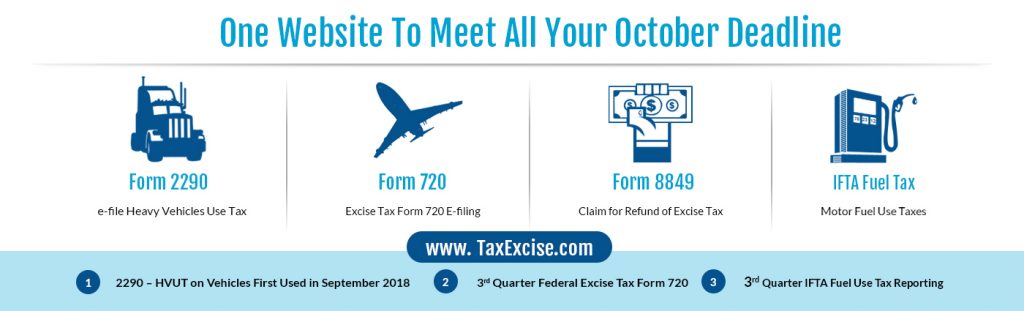

So remember, by October 31st 2018, you must prepare and file your third quarter fuel tax. Preparing IFTA returns is a tedious task as some serious calculations are involved. Taxifta.com comes to your rescue by taking away the load of calculations from your way. Log on to www.taxifta.com and prepare your IFTA returns within minutes.

* HVUT Form 2290 for Heavy Vehicles First used in the Month of September is also Due by October 31st 2018.

*Federal Quarterly Excise Tax Form 720 for the Third of 2018 is also Due by October 31st 2018.

Our Tax Experts are always available for your assistance @ 1-866-245-3918, you may also write to them @ support@taxexcise.com or you may ping them using the LIVE CHAT Option on the Website.